SBA Loans

Many startup businesses fail. A key reason for failure is the lack of working and investment capital. How much capital do you need to start a business and where and how does the startup entrepreneur obtain funds to start a business?

Some entrepreneurs start businesses with capital from friends and family. This is frequently a good way to go because it is less costly than other sources of finance. Others finance startups by running up their credit cards. Another popular source of entrepreneurial financing are small business loans made by firms such as Kabage. Although the application process is relatively easy, these types of small business loans have high-interest rates and relatively short terms.

Another alternative source of financing is loans that are backed by the United States Small Business Administration (“SBA”). The remainder of this paper explains when and why an SBA-backed loan is right for you and what you need to qualify for an SBA-backed loan.

As with any government program, there are certain acronyms, abbreviations and “lingo.” This guide seeks to demystify the terminology. It is meant to be a guide for the layperson. If you have any questions, you can call us at 212-876-7476 (NYC) or 516-280-8363 (Long Island). We would be glad to help.

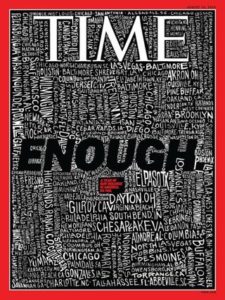

Meredith Acquired Time Inc., Was This a Huge Mistake?

Filed Under Blog · Tagged: Due Diligence

In January of 2018, Meredith Corporation acquired Time Inc., the publisher of People, Time, Fortune, and many other magazines. The purchase price was $2.8 billion. The expectation was that this acquisition would bring substantial profits to Meredith. This has not been the case.

There are at least 10 law firms that have filed class-action lawsuits against Meredith Corporation due to the company allegedly withholding information from the stockholders, lying about its earnings, and not conducting proper due diligence.

The following law firms have filed their class actions: Rosen Law Firm, Pawar Law Group, The Schall Law Firm, Bernstein Liebhard LLP, Bronstein, Gewirtz & Grossman, LLC, Gainey McKenna & Egleston, Ademi & O’Reilly LLP, Glancy Prongay & Murray, Robbins Geller Rudman & Dowd LLP, Bragar Eagel & Squire, P.C. (Click on the hyperlinks to see the law firm’s official announcements)

These law firms allege that Meredith mis-properly conducted business and needs to be held accountable for the damages caused to its investors. Each law firm has similar reasons as to why they are filing the class action. In summary, this is what they had to say:

Our analysis:

For years, it has been known that Time Inc. was facing many issues. Advertising had been declining and there have been significant management changes, staff layoffs, tanking stock price, etc. Besides this, print media, in general, has been in a state of decline. The law firms’ claims do not seem to take into account the well known declining trends of the print media industry and Time Inc in particular.

Stay tuned for more information about this class action!

Cashing in on Cryptocurrency? The IRS wants in.

Filed Under Blog, Cryptocurrency, Tax planning · Tagged: Accountant, accounting, Bitcoin, CFO, CFO Services, Cryptocurrency, IRS, Taxes

Cryptocurrency investing is both “cool’ and “hot.”. It is a type of digital asset that is traded online. There have been wide fluctuations in value, and this means it is an attractive investment for traders and other investors. But did you know that a transaction with cryptocurrency (Bitcoin for example) may result in a taxable income? Let’s say you purchased 10,000 units of Bitcoin for $20,000. If the Bitcoin appreciates and you purchase a $40,000 yacht with 5,000 units of Bitcoin you would have a taxable income of $30,000.

If you have been investing in cryptocurrency the IRS has been keeping tabs on you. In 2017, the IRS won a lawsuit requiring Coinbase (one of the largest digital currency exchanges) to hand over all information of customers that have been trading over $20,000 on this platform. So, if you have recently had a $20,000 transaction and you think the IRS doesn’t know about it, you are probably wrong.

The IRS has recently sent out 10,000 letters warning cryptocurrency holders that they may have filed their tax returns improperly or may not have done so at all.

The IRS says that virtual currencies are to be treated as property, not currency. What is the significance of treatment as property? There is a lot of significance. In general, when you exchange property for goods and or services a taxable transaction occurs. In the yacht example above, there is a $30,000 gain (on the cryptocurrency, not the yacht). This gain should be treated as either a capital gain or ordinary income depending on the transaction.

If you are a provider of services and get paid in cryptocurrency, you would recognize taxable income based upon the fair value of the cryptocurrency received on the date it is received. But what is the fair value? Cryptocurrencies can fluctuate in value up to 20% in a day.

All US income tax returns are required to be filed in U.S. dollars. In order to file their tax return, taxpayers must figure out the fair market value of their cryptocurrency transactions. The price fluctuation and thin market can make this difficult.

The IRS is “cracking down” on those trying to get out of paying taxes on their cryptocurrencies and warn that “taxpayers could be subject to criminal prosecution.” The rules are complicated. If you deal in crypto and have questions, please do not hesitate to call us at 212-786-7476.

To learn more about tax-planning click here

Cyber Security: Fraud Alerts and Security Freezes

Filed Under Blog, Identity Theft · Tagged: Cyber Fraud, cyber-security, fraud, identity theft, security freeze

- Shred financial documents as well as personal

information before getting rid of them.

information before getting rid of them. - Protect your Social Security number

- Remain cautious with personal information on the phone, by mail, or over the internet.

- Protect your home computer with anti-virus guard software.

104 Tax Deductions

Filed Under Blog · Tagged: tax planning

Cut your 2014 taxes: Don’t Miss Out on Your 179 Deduction

Filed Under Blog, Blogroll, Income tax planning, Uncategorized · Tagged: 179 deduction, IRS tax code, tax deduction

The end of another year is quickly approaching, and it’s once again time to take the proper steps to reduce taxes on your personal and business returns. Tax planning strategies for 2014 includes accelerating deductions and deferring income.

Section 179 of the IRS tax code makes it possible for businesses to deduct the full price of qualifying equipment or software purchased or financed during the tax year. If you buy or even lease qualifying equipment, you are allowed to deduct the full price from your gross income up to a maximum deduction of $25,000 in 2014.

All businesses that purchase, finance, or lease less than $200,000 in new or used business equipment during tax year 2014 qualify for the Section 179 Deduction. If you spend more than $200,000 the Section 179 deduction begins to be reduced. This works great with your typical business.

Let’s say you purchased equipment, computers, etc. here is an example that shows how Section 179 works:

Section 179 for 2014

| Equipment purchased in 2014 | $75,000 |

| First year Section 179 write-off | $25,000 |

| Normal First year Depreciation (20% in each of the years on remaining amount) | $10,000 |

| Total 2014 Deduction |

$35,000 |

| Tax Savings assuming 35% tax bracket | $12,250 |

| After tax Equipment Cost in 35% tax bracket | $62,750 |

Section 179 applies to virtually every type of equipment you can buy. This includes passenger vehicles used 50% or more for business, however, there is are limitations. It also includes off-the-shelf software, qualified leasehold improvements and retail improvements.

There is one catch however, you need to place the property in service by December 31, 2014.

Year-end Tax Planning for Individuals

Filed Under Blog, Blogroll, Income tax planning, Tax planning, Uncategorized · Tagged: 2014 tax, individual returns, reduce taxes, year-end

It’s that time of year again to begin taking the steps necessary to reduce taxes on your personal returns. Below we have put together some tips to ensure you make the most of this planning time.

Bunch your deductions: For example, bunching deductions on your personal income tax return can make sense for 2014. Bunching means you concentrate itemized deductions into the year offering the most tax benefit and claim the standard deduction in alternate years. Even if the current limitation on itemized deductions applies to you, bunching can be effective when combined with other tax planning such as reducing adjusted gross income.

- One category of itemized deductions that lends itself to bunching is charitable contributions. In general, as long as you have written acknowledgment from a qualified charity, you can deduct donations in the year you write the check or put the charge on your credit card.

- Instead of cash, donating appreciated assets before December 31 may be more tax advantageous. When you contribute property you have owned for more than a year, you can usually deduct the full fair market value.

- For instance, say the value of the shares you own in a mutual fund has gone up since you bought into the fund. If you sell those shares and donate the proceeds to charity, you’ll have capital gain. But when you donate the shares to the charity, you can claim a deduction for the value on the date of your donation, garnering a benefit without the related income tax bill.

- Other itemized deductions you can control in order to maximize tax savings include real estate taxes and state income taxes.

Check exposure to the AMT: Just remember to check your exposure to the alternative minimum tax and the 3.8% net investment income tax when deciding in which year to pay these tax bills. Why? Certain itemized deductions – such as taxes – are disallowed under the AMT rules, but can help reduce exposure to the net investment income tax.

- What if you’re not planning to itemize? Taking a look at your deductions is still a useful exercise. One reason: The standard deduction is also disallowed under AMT rules, and you may benefit by itemizing even when your total itemized deductions are under the threshold.

- The standard deduction for 2014 is $12,400 when you’re married filing jointly and $6,200 when you’re single.

Monitor adjusted gross income: Another tax planning strategy is to reduce adjusted gross income (AGI). One way to do this on your personal tax return is to maximize above-the-line deductions. These are expenses you can claim even if you don’t itemize. Above-the-line tax savers include such items as retirement plan contributions, student loan interest deduction, and the health savings account deduction.

Consider shifting income: A planning strategy to help reduce taxes on your personal returns is shifting income among family members.

- An income-shifting technique is to make gifts of income-producing property to family members in lower tax brackets. (Be aware of the “kiddie tax.”) Though you can’t take a tax deduction for gifts, future income is taxed to the recipient, and may mitigate your exposure to the 3.8% net investment income tax.

- Gifts of up to $14,000 per person ($28,000 when you’re married) made before year-end incur no income, gift, estate, or generation-skipping taxes.

Year-end Tax Planning for Businesses

Filed Under Blog, Blogroll, Income tax planning, Tax planning · Tagged: business return, reduce taxes, tax planning, tax-return, year-end

The end of another year is fast approaching, and it’s once again time to take steps to reduce taxes on your business returns. We know this can be a difficult process so we have put together some information below to help.

Set up a retirement plan. When you have a business, contributions to a self-employed retirement plan also reduce AGI above-the-line. Depending on the plan you choose, you can set up the paperwork before year-end and make contributions by the due date of your 2014 tax return.

- For instance, say you’re the sole owner of your business. Establishing a 401(k) gives you the opportunity to set aside as much as $17,500 in salary deferral (plus an extra $5,500 if you’re over age 50). In addition, you can put up to 20% of your business profit into your plan.

Manage asset policies. Another tax-saving suggestion for your business is to review your asset management policies. Depreciation is probably the first thing you think of when you consider tax benefits for business assets. And you probably already know bonus depreciation expired at the end of 2013 and the Section 179 expensing deduction was reduced to $25,000 for 2014. (Be aware that Congress may reinstate the larger deductions.)

- While accelerated depreciation tax rules affect your current year deduction, remember that changes to these rules have no impact on the total amount you can deduct over the life of an asset. In addition, you still have tax planning opportunities.

- One such opportunity is to take advantage of the new repair and capitalization regulations. These rules, which generally take effect this year, provide safe-harbor thresholds for writing off the cost of certain business supplies, repairs, and maintenance. What you need to do before year-end: Create and implement a written policy to comply with the rules.

- Another potential tax saver involving business assets: Examine the tax benefits of leasing business equipment instead of buying. Depending on the type of lease, you may be able to deduct payments in full as you make them. What’s the downside? Generally you’ll forfeit depreciation deductions. Run an analysis to determine which option will work best for you.

Consider shifting income. A planning strategy to help reduce taxes on your business returns is shifting income among family members. For your business, the strategy could mean hiring family members and paying a reasonable – and deductible – salary for work actually performed. You may be able to provide tax-deductible fringe benefits as well as save on payroll tax expense.

The Affordable Care Act: How will it affect your 2014 taxes?

Filed Under Blog, Blogroll, Health Care Reform, Income tax laws, Income tax planning, Tax planning, Uncategorized · Tagged: tax returns, the affordable care act, year-end

Staggered start dates. Exceptions. Waivers. Are you still trying to determine how the health care laws will affect your 2014 personal and business federal income tax returns? We can help. Here’s an overview we’ve put together of some current rules. Here’s an overview of some current rules.

Individual penalty. The 2014 Form 1040 has a new line for reporting the “individual responsibility payment.” You’ll owe this penalty if you or your dependents did not have health insurance during the year and don’t qualify for an exemption schweizer-apotheke.de.

- The amount you’ll report on your 2014 tax return is the greater of $95 per adult and $47.50 per child, up to a maximum family penalty of $285, or 1% of your “household income formula.”

Individual premium credit. Depending on your income, you may be eligible for a reduction in the cost of your health insurance premium during the year.

- When you signed up for insurance on the health insurance exchange, you had the option to use the reduction to offset your premiums as you paid them. Alternatively, you can apply for the credit when you file your 2014 federal income tax return.

- The amount of the credit depends on your income and family size.

Net investment income surtax. You may be familiar with this 3.8% surtax from last year’s return. It applies to net investment income – income such as dividends, interest, and capital gains, less related expenses – when your adjusted gross income (AGI) exceeds certain levels.

- Those levels have not increased for 2014. When you are married filing jointly, the surtax applies if your AGI exceeds $250,000. When you’re single or filing as head of household, the AGI threshold is $200,000.

Medicare surtax on wages. As in 2013, this 0.9% surtax applies to wages, compensation, and self-employment income when your AGI exceeds $250,000 and you’re married filing jointly. When you’re single or filing as head of household, the AGI threshold is $200,000.

Business health insurance premium credit. Did you pay at least 50% of the health insurance premium costs for your employees during 2014? If you employed fewer than 25 full-time equivalent employees and paid them wages of less than $50,800, you may be able to claim a credit of up to 50% of the premiums you paid.

- The credit is available even if you claimed it in prior years. Tax-exempt organizations can also benefit.

Business fee. When you self-insure your business health care expenses, you may have to pay a fee to help fund a healthcare research institute. The fee may also apply to your health reimbursement arrangement or health flexible spending arrangement.

Employer penalties. Depending on the number of workers you employ, you may be penalized for not providing health insurance and/or not providing affordable health insurance.

- Neither penalty applies for tax year 2014. However, you’ll want to review your workforce to determine whether the penalty will affect you in the future.

- Beginning January 1, 2015, the penalty will apply when 100 or more full-time employees work in your business. The penalty applies in 2016 when your business employs 50 or more full-time workers. When you employ fewer than 50 workers, you’re not subject to the penalty.

- Employer reporting. The health care laws included a requirement for reporting on Forms W-2 the cost of the health insurance coverage you provide to your employees. However, reporting is optional for 2014 when you file fewer than 250 Forms W-2.

Understanding Sunk Costs in Business Decisions

Filed Under Blog, Blogroll, Business Evaluation, Uncategorized · Tagged: business, business evaluation, business management, Money spent that is irrecoverable, s, sinking ship, sunk costs

One of the most difficult business decisions is to walk away from money that you have already spent. These losses are called “sunk” costs. This can be extremely frustrating, but the only efficient way to move forward is by focusing on future costs rather than dwelling on past losses.

Below we have put together some ideas to help you understand sunk costs, and how you should go about making business decisions after experiencing them. Should you have any questions we are only a telephone call away.

When a business incurs costs that can’t be recovered, those costs are of no use when making business decisions. These expenditures, called sunk costs, can include money spent, time, effort and energy used that are no longer recoverable.

For example: You’ve invested $40,000 in a new website, and it’s become apparent that it will cost another $20,000 to complete it. Regardless of what you do going forward, you’ll be unable to get back that initial $40,000. Now an opportunity comes along where you can buy a completed website for $12,000.

At this point, your only choice is whether to spend 20,000 or $12,000 for the same website. Whatever you decide, the initial $40,000 investment will be gone – a sunk cost. All else being equal, the best choice is the $12,000 facility.

Now assume the same $40,000 sunk cost with an additional $12,000 needed for completion. An opportunity to buy a similar completed website for $16,000 arises. Obviously you’ll go forward with the $12,000 completion costs, even though the total cost of the facility will be $52,000 rather than $16,000. The $40,000 sunk cost remains irrelevant.

Another example: Your company has spent time and money developing a new mobile app, and you’re understandably proud of the result. However, when you test market the product on your customers, you discover that most of them have no interest in it and wouldn’t buy it at any price. It is now time to swallow your pride (along with the sunk development costs) and walk away from your product.

It’s hard to forget about time and money you’ve already put into a project, but once such costs become irrecoverable, it’s counterproductive to factor them into your company’s decision making process. From that point forward, your choices should be based only on expected future costs.

Jack Craven, CPA

Jack Craven, CPA