SBA Loans

Many startup businesses fail. A key reason for failure is the lack of working and investment capital. How much capital do you need to start a business and where and how does the startup entrepreneur obtain funds to start a business?

Some entrepreneurs start businesses with capital from friends and family. This is frequently a good way to go because it is less costly than other sources of finance. Others finance startups by running up their credit cards. Another popular source of entrepreneurial financing are small business loans made by firms such as Kabage. Although the application process is relatively easy, these types of small business loans have high-interest rates and relatively short terms.

Another alternative source of financing is loans that are backed by the United States Small Business Administration (“SBA”). The remainder of this paper explains when and why an SBA-backed loan is right for you and what you need to qualify for an SBA-backed loan.

As with any government program, there are certain acronyms, abbreviations and “lingo.” This guide seeks to demystify the terminology. It is meant to be a guide for the layperson. If you have any questions, you can call us at 212-876-7476 (NYC) or 516-280-8363 (Long Island). We would be glad to help.

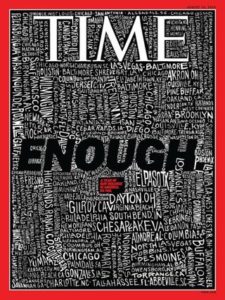

Meredith Acquired Time Inc., Was This a Huge Mistake?

Filed Under Blog · Tagged: Due Diligence

In January of 2018, Meredith Corporation acquired Time Inc., the publisher of People, Time, Fortune, and many other magazines. The purchase price was $2.8 billion. The expectation was that this acquisition would bring substantial profits to Meredith. This has not been the case.

There are at least 10 law firms that have filed class-action lawsuits against Meredith Corporation due to the company allegedly withholding information from the stockholders, lying about its earnings, and not conducting proper due diligence.

The following law firms have filed their class actions: Rosen Law Firm, Pawar Law Group, The Schall Law Firm, Bernstein Liebhard LLP, Bronstein, Gewirtz & Grossman, LLC, Gainey McKenna & Egleston, Ademi & O’Reilly LLP, Glancy Prongay & Murray, Robbins Geller Rudman & Dowd LLP, Bragar Eagel & Squire, P.C. (Click on the hyperlinks to see the law firm’s official announcements)

These law firms allege that Meredith mis-properly conducted business and needs to be held accountable for the damages caused to its investors. Each law firm has similar reasons as to why they are filing the class action. In summary, this is what they had to say:

Our analysis:

For years, it has been known that Time Inc. was facing many issues. Advertising had been declining and there have been significant management changes, staff layoffs, tanking stock price, etc. Besides this, print media, in general, has been in a state of decline. The law firms’ claims do not seem to take into account the well known declining trends of the print media industry and Time Inc in particular.

Stay tuned for more information about this class action!

Cashing in on Cryptocurrency? The IRS wants in.

Filed Under Blog, Cryptocurrency, Tax planning · Tagged: Accountant, accounting, Bitcoin, CFO, CFO Services, Cryptocurrency, IRS, Taxes

Cryptocurrency investing is both “cool’ and “hot.”. It is a type of digital asset that is traded online. There have been wide fluctuations in value, and this means it is an attractive investment for traders and other investors. But did you know that a transaction with cryptocurrency (Bitcoin for example) may result in a taxable income? Let’s say you purchased 10,000 units of Bitcoin for $20,000. If the Bitcoin appreciates and you purchase a $40,000 yacht with 5,000 units of Bitcoin you would have a taxable income of $30,000.

If you have been investing in cryptocurrency the IRS has been keeping tabs on you. In 2017, the IRS won a lawsuit requiring Coinbase (one of the largest digital currency exchanges) to hand over all information of customers that have been trading over $20,000 on this platform. So, if you have recently had a $20,000 transaction and you think the IRS doesn’t know about it, you are probably wrong.

The IRS has recently sent out 10,000 letters warning cryptocurrency holders that they may have filed their tax returns improperly or may not have done so at all.

The IRS says that virtual currencies are to be treated as property, not currency. What is the significance of treatment as property? There is a lot of significance. In general, when you exchange property for goods and or services a taxable transaction occurs. In the yacht example above, there is a $30,000 gain (on the cryptocurrency, not the yacht). This gain should be treated as either a capital gain or ordinary income depending on the transaction.

If you are a provider of services and get paid in cryptocurrency, you would recognize taxable income based upon the fair value of the cryptocurrency received on the date it is received. But what is the fair value? Cryptocurrencies can fluctuate in value up to 20% in a day.

All US income tax returns are required to be filed in U.S. dollars. In order to file their tax return, taxpayers must figure out the fair market value of their cryptocurrency transactions. The price fluctuation and thin market can make this difficult.

The IRS is “cracking down” on those trying to get out of paying taxes on their cryptocurrencies and warn that “taxpayers could be subject to criminal prosecution.” The rules are complicated. If you deal in crypto and have questions, please do not hesitate to call us at 212-786-7476.

To learn more about tax-planning click here

Do you know what the IRS is looking for? Advice for Business Owners

Filed Under Income tax planning, Uncategorized · Tagged: small business, tax planning

It is not too late to reduce your 2013 income taxes

Cyber Security: Fraud Alerts and Security Freezes

Filed Under Blog, Identity Theft · Tagged: Cyber Fraud, cyber-security, fraud, identity theft, security freeze

If you experience identity theft, you will begin to feel the confusion and strain that comes with trying to recover your good name and pilfered finances. Identity theft is a real and growing concern for everyone; remain alert and prepare before it happens. We have put together some ways to deter identity thieves and protect your information:

- Shred financial documents as well as personal

information before getting rid of them.

information before getting rid of them. - Protect your Social Security number

- Remain cautious with personal information on the phone, by mail, or over the internet.

- Protect your home computer with anti-virus guard software.

In addition to the tips provided to deter identity theft, there are ways to help once you’ve detected your identity might be in danger. Utilizing these available tools could prevent and minimize potential losses. Here are two options to consider if you suspect your personal data has landed in the wrong hands.

Fraud alert. Say you lose your wallet or discover suspicious charges in your credit report. Don’t hesitate to contact one of the three main credit-reporting agencies (Experian, TransUnion, or Equifax). That agency will contact the others. Report that your identity may have been compromised and ask the company to place a fraud alert in your credit file. When lenders and service providers see this warning, they’re supposed to take extra precautions before granting credit in your name. Fraud alerts are free and can be renewed indefinitely in 90-day intervals. This alternative isn’t fail safe, but if you suspect you’ve been victimized, setting up a fraud alert is a prudent first step. A fraud alert is beneficial because it will make it difficult for an identity thief to open more accounts in your name. You could be contacted by a business for identity verification once you have an alert on report.

Security freeze. Also known as a credit freeze, this option is more restrictive than a fraud alert. When you “freeze” your record, lenders aren’t allowed to see your credit report unless you grant permission by temporarily lifting the freeze. To start the process, contact all three credit bureaus. You may be asked to provide evidence (for example, a police report) that you’ve been the victim of identity theft. Otherwise, you may have to pay a fee each time you freeze or unfreeze your account. Processing times for establishing the freeze can vary. You’ll need to take that into consideration when you plan financial activities that require a credit check, such as a car loan, revising the terms of your mortgage, or applying for a new job.

For more information regarding security theft, please read our Cyber Safety blog post. In order to establish good internal controls for your business, check out our blog post on How entrepreneurs can prevent fraud in their business.

Contact us at (212) 786-7476 if you have any questions about security theft issues.

104 Tax Deductions

Filed Under Blog · Tagged: tax planning

Worried about the Cyber-Safety of your Business? How you can avoid E-mail Scams.

Filed Under Bonnier, Business E-Mail Scams, Keith Kelly, Pfishing, Uncategorized · Tagged: Bonnier, Cyber Fraud, cyber-security, ic3, Internet Crime, Keith Kelly, phishing

A common belief of identity theft is that it occurs mostly to individuals, for example when social security numbers and other personal information are obtained. Businesses are also subject to identity impersonation. The remainder of this article discusses business e-mail scams and the best practices for minimizing their likelihood as suggested by the Federal Bureau of Investigation (“FBI”).

Regardless of the nature of your business, anyone opening e-mail is a potential target for hackers. These illegitimate e-mails or “phishing e-mails” imitate e-mail addresses you would commonly send mail to or receive mail from.

Keith Kelly of the New York Post reported that Bonnier Publications was defrauded of $1.5 million in May of 2015. Bonnier is a leading magazine publisher with offices in New York City and Winter Park Florida. According to Kelly, the cyber hackers breached the e-mail of then CEO David Freygang – who weeks after the scam stepped down from his position. An e-mail hacker impersonating Freygang instructed a Bonnier accounting department employee to wire transfer $1.5 million to China. Days after their first scam, cyber hackers made a second attempt at defrauding the media company. This time employees of Bonnier Publications were successful in thwarting off the thievery of the hackers, and saved the firm from another $1.5 million scam. Kelly reports that the Chinese international authorities have been “uncooperative” and have “not been helpful in identifying the owner of the account that was receiving the stolen money”. Frequently once the funds are out of the United States they are gone. It is difficult for firms and individuals to ever recoup their funds.

In 2014 American businesses were robbed for over $200 million. The average amount lost in a case of this nature was $150,000. Approximately 2,000 American businesses have been negatively affected, and the number of victims is expected to grow rapidly as computer hackers increase in their ability and popularity. We are all potential victims for attacks, but most likely to be preyed upon are companies that send wire transfers and do not have proper internal controls. It is for this reason that the FBI has issued a fraud alert on wire transfers in an effort to vigilantly prevent and monitor any potential cybercrime. The FBI has a name for cyber scams such as the one Bonnier suffered, business e-mail compromise scams (BEC). In response to the rise of recent cyber attacks, the FBI has released guidelines and measures to prevent loss and repeat attacks on innocent U.S businesses. The IC3 Public Service Announcement does just that.

SUGGESTIONS FOR PROTECTION

The IC3 suggests the following measures to help protect you and your business from becoming victims of the BEC scam:

- Avoid Free Web-Based E-mail: establish a company website domain and use it to establish company e-mail accounts in lieu of free web-based accounts.

- Be careful what is posted to social media and company websites: job duties/descriptions, hierarchal information, and out of office details.

- Be suspicious of requests for secrecy or pressure to take action quickly.

Consider additional IT and financial security procedures and 2-step verification processes:

- Out of Band Communication: establish other communication channels, such as telephone calls to verify significant transactions. Arrange this second-factor authentication early in the relationship and outside the e-mail environment to avoid interception by a hacker.

- Digital Signatures: both entities on either side of transactions should use digital signatures. However, this will not work with web-based e-mail accounts. Additionally, some countries ban or limit the use of encryption.

- Delete Spam: immediately delete unsolicited e-mail (spam) from unknown parties. Do NOT open spam e-mail, click on links in the e-mail, or open attachments. These often contain malware that will give subjects access to your computer system.

- Forward vs. Reply: do not use the “Reply” option to respond to any business e-mails. Instead, use the “Forward” option and either type in the correct e-mail address or select it from the e-mail address book to ensure the intended recipient’s correct e-mail address is used.

- Significant Changes: beware of sudden changes in business practices. For example, if a current business contact suddenly asks to be contacted via their personal e-mail address when all previous official correspondence has been on a company e-mail, the request could be fraudulent.

- Always verify via other channels that you are still communicating with your legitimate business partner.

Our firm strongly suggests that you take the time to click and read the following link to a FBI Public Service Announcement provided by their internet cybercrime specialists. If you believe that your business may have received a fraud email or is victim to BEC, we recommend that you immediately file a complaint with the IC3 at www.IC3.gov . Remember to protect business information because the business saved could be your own. We would be glad to help you to review your internal controls over wire transfers. Please call us at 516-208-8363 if you have questions or would like additional information.

Summer Time Tax Tips

Filed Under Uncategorized · Tagged: 2015 return, deductions, summer planning, summer tax tips, summer time, tax tips

It’s getting hot outside, and you probably don’t want to think about tax planning. But we have put together some summer tax tips so that you can get the most out of your 2015 return.

Before you head off to the beach, please take a look below at what we have prepared.

- Take a credit for summer day care. If you have one or more children under the age of 13, your costs of in-home childcare, a day care facility, or sending the kids to day camp may qualify for the Child and Dependent Care Tax Credit. The costs must be incurred to enable you (and your spouse, if you file jointly) to work or look for work and you generally must report some earned income. Payments to your spouse, your dependent, or your child who is under age 19 at the end of the year aren’t eligible. Overnight camps and summer school tutoring won’t qualify either.

The credit can equal up to 35% of qualifying expenses, depending on your income. Total expenses are limited to $3,000 for one child and $6,000 for two or more.

- Combine business with pleasure. Add vacation days to your summer business trip, and bring the family along. You can deduct most of your own (but not your family’s) unreimbursed costs, such as airfare, meals and lodging during the business portion of your trip.

- Put your kids to work. If you own a business, give your children a summer job. You can deduct their wages, and if you’re a sole proprietor, you don’t have to withhold social security or Medicare taxes as long as your kids are under 18. They can even use their earnings to set up an IRA.

- Clean out your garage and take a deduction. Donate your unwanted property to a qualifying charity and deduct the fair market value. Make sure to get a receipt and check the documentation rules for high-value items.

Understanding the Breakeven Point

Filed Under Uncategorized · Tagged: breakeven point, fixed costs, loss, profit

The breakeven point in your business is where all direct and indirect costs have been met. You are neither making nor losing any money. The breakeven point can be measured in number of units sold, dollars of total sales, or possibly hours billed out.

The calculation of the breakeven point is an iatrical component of the cost volume profit analysis for any business. We’ll explain more about this below.

- To calculate your breakeven point, you must first determine your direct (variable) and your indirect (fixed) costs. Direct costs vary with the number of units sold. For every unit you sell, you must buy another set of the components. Your indirect costs don’t normally vary for a given volume of business. Your gross profit per unit (sales less direct costs, known as the contribution margin) goes toward paying for these indirect costs. Once the indirect costs have been paid, you have reached the breakeven point. The gross profit from every unit sold over the breakeven point goes to the bottom line as profit.

Preventing Employee Fraud

Filed Under Uncategorized · Tagged: Analyzing and Planning, Managing Cash Outflows, Monitoring Inventory, Practicing Cost Control, Using Cash Wisely

As an entrepreneur, you work hard for your money. There is almost nothing worse than experiencing pilferage, embezzlement, and other types of misappropriation. Internal controls are extremely important to the entrepreneurial company.

We have put together a guide that contains 10 steps to help you protect the earnings and assets of your company such as:

- Using Cash Wisely

- Managing Cash Outflows

- Practicing Cost Control

- Analyzing and Planning

- Monitoring Inventory

Please check out our guide under the “Services” tab of our website, and give us a call if you have any questions about Preventing Employee Fraud.

Jack Craven, CPA

Jack Craven, CPA